yoBTC

Earns yield while representing exposure to Bitcoin, with Yo Protocol optimizing across the best Bitcoin yield opportunities

Earn while you hold. Traditional investing often requires you to choose between growth and income. With Yield Earning Crypto Traded Funds (CTFs), you don’t have to make that choice. These innovative financial instruments let you capture both price appreciation and passive income from your crypto holdings, all while maintaining the diversification benefits of index investing.

Yield Earning CTFs are on-chain index funds that contain assets specifically selected for their ability to generate additional returns beyond price movements. Unlike traditional crypto traded funds that simply track price performance, these funds hold yield-generating tokens that actively earn income while you maintain your position.

Before we dig into the nuts and bolts of how it works, let’s take a look at the assets that enable us to earn yield.

INDX’s yield earning indexes contain two types of yield earning assets, we will break them down below.

Yo Protocol assets (yoBTC, yoETH, and yoUSD), which are tokenized versions of major cryptocurrencies designed to generate yield. Yo Protocol acts as a Yield Optimizer that automatically moves funds across the best-performing pools across multiple blockchains, ensuring you’re always getting the highest risk-adjusted yield without the complexity of managing it yourself.

Earns yield while representing exposure to Bitcoin, with Yo Protocol optimizing across the best Bitcoin yield opportunities

Generates returns while tracking Ethereum, automatically finding the highest-yielding ETH strategies

Provides stable returns while maintaining dollar exposure, optimizing across stablecoin yield pools

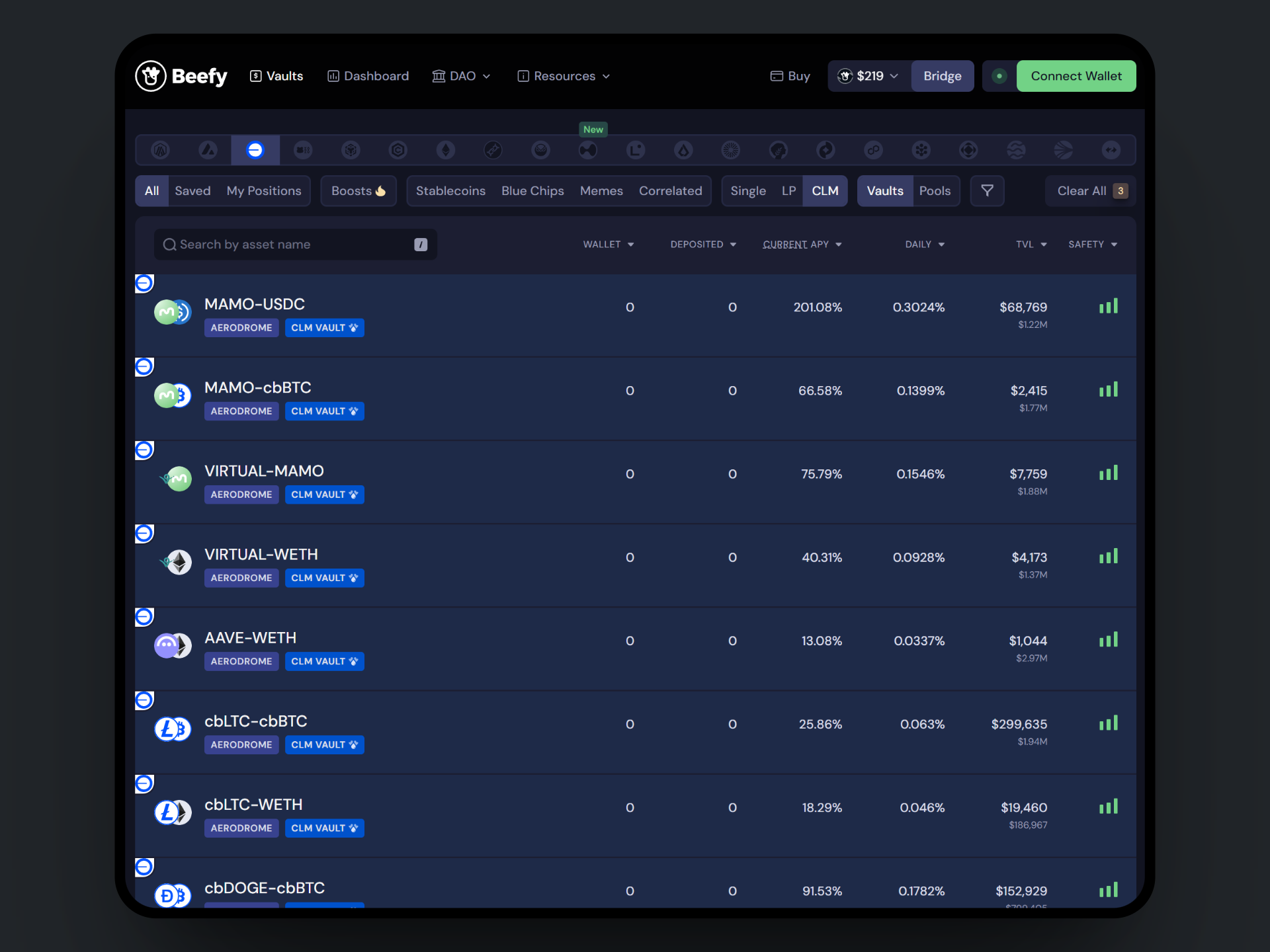

Beefy is a decentralized, multichain yield optimizer that allows users to earn compound interest on their crypto holdings. Beefy earns you the highest APYs with safety and efficiency in mind through automated strategies that handle complex DeFi operations.

INDX primarily uses Beefy’s CLM vaults for yield earning. CLM stands for “cowcentrated liquidity manager” and represents Beefy’s sophisticated solution for accessing concentrated liquidity opportunities.

Concentrated Liquidity Made Simple Concentrated liquidity pools offer significantly higher yields than traditional liquidity pools by allowing providers to focus their liquidity within specific price ranges. Instead of providing liquidity across all possible prices (like Uniswap V2), concentrated liquidity lets you earn a greater share of trading fees by targeting the price ranges where actual trading occurs. The tradeoff is complexity, these positions require constant monitoring and rebalancing as prices move.

Automated Range Management This is where Beefy’s CLM technology shines. CLM automates the complex process of managing concentrated liquidity positions, including:

Seamless Token Experience When you interact with CLM vaults through INDX, you benefit from Beefy’s token system:

Portfolio-Level Benefits By including Beefy CLM vault positions in yield earning indexes, INDX provides:

The combination of concentrated liquidity’s superior yields and Beefy’s automated management creates a powerful yield-generating component for INDX’s diversified approach to crypto investing.

When you hold positions in yield earning indexes, the underlying yoAssets are powered by Yo Protocol’s advanced yield optimization engine. This technology automatically scans and moves your funds across the best-performing pools on multiple blockchains, ensuring optimal risk-adjusted returns without you having to monitor or manage anything.

Similarly, Beefy CLM vaults handle the complex aspects of concentrated liquidity management: monitoring price movements, adjusting ranges for optimal fee capture, managing impermanent loss risks, and compounding all earnings back into your position.

The beauty of this system is that both Yo Protocol and Beefy handle all the complex aspects of yield farming and liquidity management. You get the benefits without any of the headaches.

Here’s where Yield Earning CTFs truly shine: portfolio-level yield optimization. While individual yield-generating tokens like those from Yo Protocol and Beefy are powerful on their own, bundling them together creates compounding benefits that go beyond what any single token can achieve.

Instead of choosing between earning yield on Bitcoin, Ethereum, stablecoins, or concentrated liquidity positions, Yield Earning CTFs let you capture optimized yields across all major cryptocurrency categories and strategies simultaneously. Each component asset continues to benefit from individual optimization, but now you’re diversified across:

This bundled approach provides superior risk management. While one asset class or strategy might experience temporary yield fluctuations, the diversified nature of the fund helps smooth out these variations, potentially providing more consistent overall returns than holding individual yield tokens.

Rather than managing separate positions across different yield-generating protocols, tokens, and strategies, you get exposure to multiple optimized yield streams through a single, simple transaction.

Let’s compare holding individual tokens versus bundled CTF exposure:

Individual Token Approach:

Yield Earning CTF Approach:

Practical Scenario: If you invest $1,000 in a diversified Yield Earning CTF, you might get exposure to:

After 6 months, each component has earned yield individually, but your single CTF position captures all of these returns automatically, rebalanced and converted to ETH when you exit—providing diversified yield generation that would be complex and expensive to achieve manually.

Starting your yield earning journey is straightforward:

Prepare Your Wallet

All you need is some ETH in a compatible wallet. INDX uses ETH as the core currency for all transactions, making the process simple and streamlined.

Choose Your Index

Browse the available yield earning indexes on the INDX platform. Each index will display its composition, current yield rates, and performance metrics to help you make an informed decision.

Enter Your Position

With a single transaction, you can enter any yield earning index. The smart contract automatically handles the complex routing and token purchases behind the scenes.

Monitor and Hold

Watch your position grow not just from price appreciation but also from the automatic yield accumulation. The platform displays your expected ETH value, which includes both your principal and accumulated yield.

Exit When Ready

When you’re ready to realize your gains, a single transaction will convert your entire position (including all accumulated yield) back to ETH.

INDX plans to expand the yield earning indexes to include other yield-generating tokens and strategies, providing even more diversification opportunities and potentially higher combined yields.

Watch this space!

Traditional yield farming requires you to constantly research opportunities, monitor multiple protocols across different blockchains, pay expensive bridging fees, and deal with unpredictable yields. Even with optimized individual yield tokens or concentrated liquidity management, you’re still limited to single-asset exposure and the complexity of managing multiple positions.

Yield Earning CTFs solve both the complexity problem and the diversification challenge. By partnering with proven yield optimization technologies like Yo Protocol and Beefy’s CLM vaults, and bundling multiple optimized assets together, you get the best of both worlds: sophisticated yield strategies with portfolio-level diversification.

This approach democratizes access to institutional-grade yield optimization while providing diversification benefits that individual yield tokens simply cannot match. Whether you’re a DeFi veteran tired of managing multiple yield positions or a newcomer wanting comprehensive crypto yield exposure, Yield Earning CTFs provide the complete solution.

The combination of index diversification, automatic yield generation, concentrated liquidity optimization, and seamless user experience represents the next evolution in crypto investing—where your money works as hard as you do, even while you sleep.

Ready to start earning yield on your crypto holdings? Visit INDX to explore the available yield earning indexes and begin your journey toward passive income generation in DeFi.